Develop AI strategy for your organization

Dr. Kavita Ganesan, Founder of Opinosis Analytics

Watch Now

17:48 Minutes The average reading duration of this insightful report.

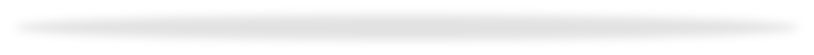

The banking sector is experiencing significant changes primarily driven by the growing integration of technology into consumers’ daily lives, evolving customer expectations, increasing interest in digital money and the volatility of cryptocurrencies. The potential annual value of AI and analytics for the global banking industry is expected to be as high as $1 trillion.

Explore a sneak peek of the full content

Credits

Lead Authors@lab45: Deepika Maurya, Chandan Jha

Contributing Authors@lab45: Sujay Shivram, Hussain S Nayak

14:33 Minutes The average duration of a captivating reports.

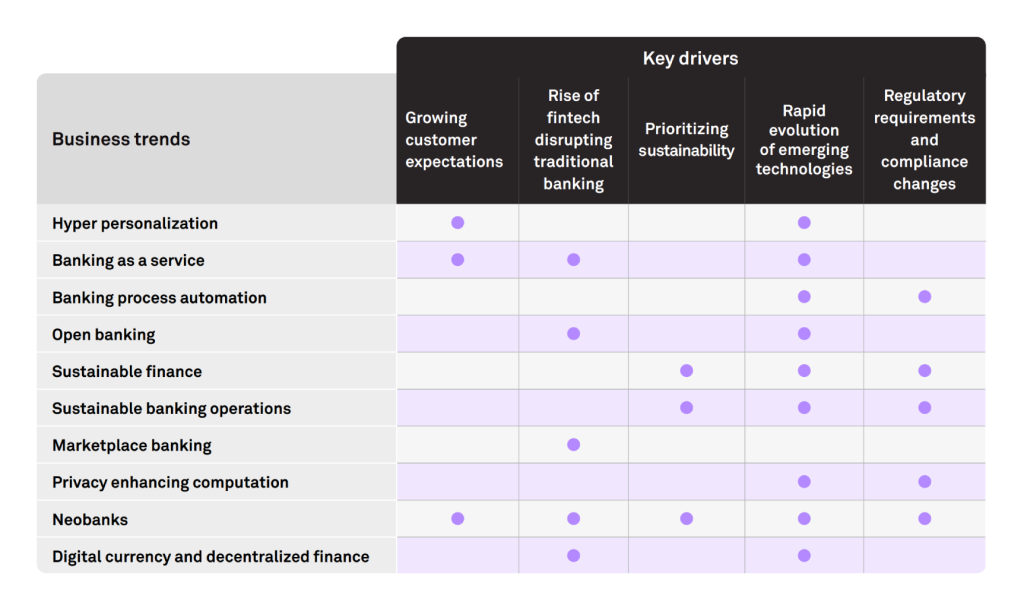

Digital identity systems have evolved and continue to evolve. They are core to our interactions with the digital world and have made great strides in both security and convenience. However, the privacy and data-use consent of identity-holders remain problematic.

We have seen Digital Identity evolve from the silo identity model to the federated identity model. The current systems reside at a very low trust level, with over 93% of users distrusting social media platform’s digital custodianship. We believe the next stage of evolution will be Decentralized Identity

Web 3.0, the internet’s next evolution aims for a decentralized interconnected and intelligent web. It aims for decentralized, peer-to-peer networks for secure, trustless transactions— without intermediaries. Unlike today's static web that does not adapt to the needs of its users, Web 3.0 will be dynamic and interactive, leveraging AI and blockchain to personalize, adapt, and democratize the internet. As user identity is crucial in Web3, DID will be foundational. We explain the ecosystem and functionality of the DID network. Download Complete Research

User benefits include credential forgery prevention, password-free authentication, spam prevention and many others. While Organizations will benefit from operational cost reduction and security cost reduction, enhanced user experience thereby improving the brand. Organizations must however use a phased approach to implement, which is explained.

We identify four key obstacles that present themselves and what organizations can do to overcome them.

The global decentralized identity market was valued at $285 million in 2022 and is expected to grow at a CAGR of 88.7% over the next 5 years. We evaluate top players and products in the market and how they have helped the technology evolve. Download Complete Research

Credits

Author@lab45: Sujay Shivram, Abhigyan Malik

16:11 Minutes The average duration of a captivating reports.

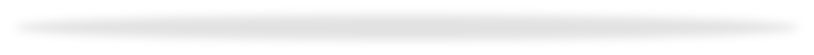

Manufacturing is becoming more smarter, efficient, precise, and sustainable by adopting IIoT, AI, Robots, Blockchain, and 5G for operations optimization. Manufacturing business trends are enabling flexible & transparent supply chains, customer-centric & agile production, ecosystem collaborations, and new business models.

The convergence of advanced technologies with labour, supply chain, and demand challenges is driving full automation. Nearly 84% of manufacturers have adopted or are considering smart manufacturing. Manufacturers are exploring tech-enabled ecosystem partnerships, reshoring, and factory-in-a-box model to address supply chain instability. AI, IIoT, Big Data & Analytics, Robotics, 5G & Edge Computing are enabling data collection, pattern identification, and prediction for process optimization and efficiency improvement. AI in manufacturing is expected to reach $115 billion in 2032 globally. Blockchain is ensuring supply chain and ecosystem security. Driven by regulations and environmental commitments, manufacturers are adopting technologies to reduce emissions. On-demand production, mass customization, and subscription-based products are enhancing customer experience. Download Complete Research

Credits

Lead Authors@lab45: Parag Arora

Contributing Authors@lab45: Hussain S Nayak

This is your invitation to become an integral part of our Think Tank community. Co-create with us to bring diverse perspectives and enrich our pool of collective wisdom. Your insights could be the spark that ignites transformative conversations.

Learn MoreKey Speakers

Thank you for subscribing!!!