Are LLMs the Answer to Everything

Prof. Mausam, IIT Delhi

Watch Now

10:24 Minutes The average reading duration of this insightful report.

GenAI is changing the banking industry through work automation, individualized customer experiences, and fraud detection. Operational cost savings from using GenAI chatbots in banking globally is 35 times more than not using GenAI. GenAI helps banks increase productivity, lower expenses, and enhance customer happiness.

Explore a sneak peek of the full content

Among industries globally, GenAI could add about $ 3.5 trillion annually in productivity on average, out of which the banking sector would be nearly 8 per cent. Banks are starting with applications in software development, chatbots and media content generation. GenAI has vast potential to execute business and technology processes autonomously. The operational cost savings from using GenAI chatbots in banking reached $7.3 billion globally. It is 35 times the operational savings without using GenAI. The integration of GenAI with virtual assistants has significantly enhanced customer support and experience. GenAI enables banks to automate crucial processes such as customer onboarding, fraud detection, and risk management. As a result, employees can concentrate on more intricate tasks, such as delivering exceptional customer support. The banking sector can significantly benefit from this, leading to an overall increase in efficiency. Download Complete Research

Empowering customers through GenAI

Corporate banking, retail banking and software engineering are the most value-creating functions with each providing a value of about $ 50 billion. The rest of the functions include wealth management, asset management, risk, IT and finance and HR. Download Complete Research

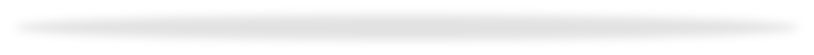

The diagram below shows the impact of GenAI on banks’ functional architecture

GenAI is in nascent stage, but it has the potential for vast changes in banking. The following use cases are expected to prevail in future:

Credits

Author@lab45: Poonam Pawar, Hussain S Nayak

14:40 Minutes The average duration of a captivating reports.

Foundational for identity verification and rights access, government-issued IDs face breaches and inefficiency within centralized systems. Enter Decentralized Identity solutions, redistributing verification control to individuals. But is it applicable for equally for all government services?

Decentralization of government-issued IDs is a complex issue with potential benefits and drawbacks. Whether government issued Ids should be decentralized or not depends on various factors that we delineate. Any decision on decentralization should be carefully considered and implemented with caution to ensure that they do not breach security or undermine the government’s programs. Download Complete Research

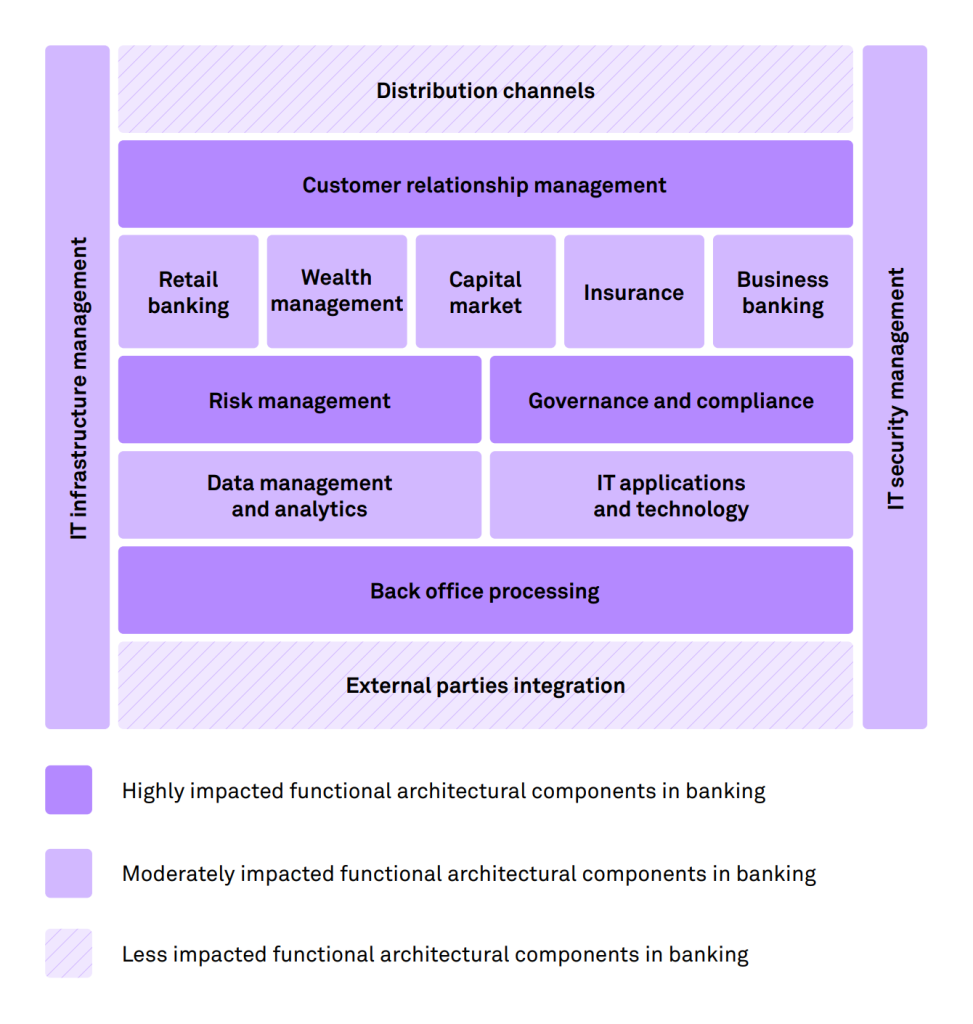

We detail out the current Issuing process typically followed by governments today and identify several challenges and issues that face it today. This includes Ids like the Passport, Licenses, Voter cards and Social security cards. All of them are critical and everyone can do with an easier and more fool proof process for the same.

We evaluate the different government functions such as Education, healthcare, elections, security, taxation, etc and analyze which of these would be most suitable to be decentralized. We map them on a matrix of Complexity & Coordination and the Need for scrutiny to give us an easy framework for assessment. Download Complete Research

We end by considering the long term onjectives and intended outcomes of such an exercise.We feel that Decentralized Identity solutions can rebuild trust in public institutions by empowering residents with data control.

Credits

Author@lab45: Sujay Shivram, Abhigyan Malik

11:39 Minutes The average duration of a captivating reports.

By acquiring 100+M users in first 3 months of launch, ChatGPT has brought the field of Generative AI (GenAI) into mainstream awareness. The adoption of ChatGPT and similar applications have positioned Generative AI (as well as “Deep Learning”) as the newest disruptive tech after cloud computing.

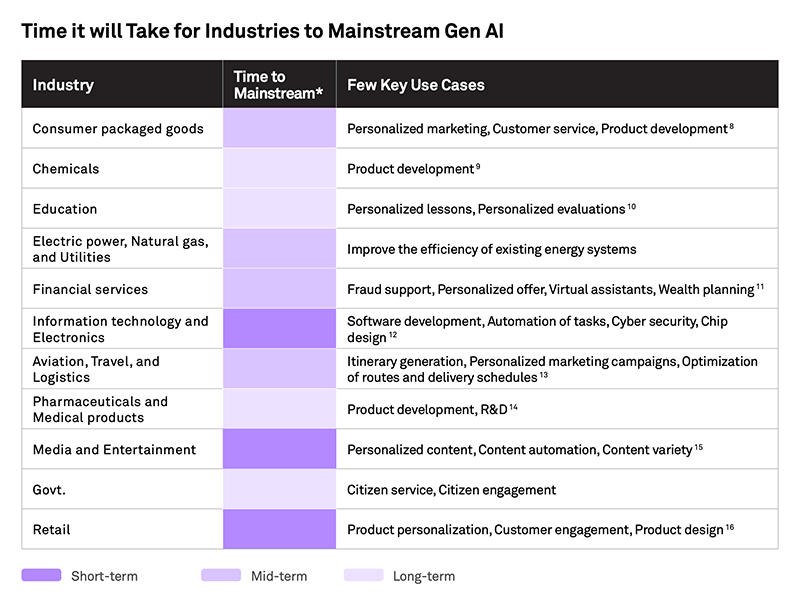

Generative AI, a field of Artificial Intelligence, refers to computational models that are trained on massive amounts of input data (300bn words in the case of ChatGPT). They can synthesize data, draw inferences and create new outputs in the form of text, images, video, audio, new data and even code.

Two architectures have made GenAI immensely valuable

ChatGPT, for instance, uses the transformer model along with Human Feedback Reinforcement training to generate high quality outputs. Training a model requires intensive computational power (supercomputers were used to train GPT3) and significant investments (OpenAI being a key example). But once a model is trained, it can be optimized for a larger user base. Download Complete Research

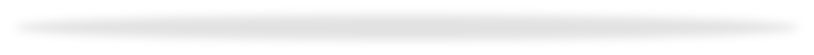

The market is expected to grow from $8B in 2022 to $109B in 2030 at a CAGR of 34.6%. Key facts as follows

Need for content synthesis

We generate ~2.5 quintillion bytes of data every day on the internet. This not only makes searching for information tough but also makes inferring tougher, for regular users. GenAI tools can search, synthesize and compose an answer.

Democratization of content creation

We are moving from a search and retrieval economy to an infer and compose economy. People used to prompt algorithms to search and retrieve information but now they can prompt algorithms to infer and compose information.

Instant economy

Digital natives prefer tools that enable instant creation of content e.g. Tik Tok. ChatGPT can generate a word in 350ms after processing database of 300B words.

Access to massive computational power

The ability to instantly process and compose information using cloud computing.

Evolution of deep learning neural networks

Large Language Models have become openly available. These models help organize much of the internet’s information and develop patterns to mimic human decision-making.

Download Complete Research

GenAI will fundamentally change several functions in enterprises leading to improved productivity and performance of employees. A Few areas of business where it will have the biggest impact are as follows:

Content creation

Gen AI will lead to more automation in content creation. It will not only reduce the cost of content creation but also increase the quality & variety of content created. Generative AI based DIY Apps are expected to emerge for marketing and design functions.

Content personalisation

Marketing touchpoints like newsletter, websites, videos, metaverse etc. will get hyper-personalized. This will improve brand engagement and conversion ratio of the sales funnel.

Drug discovery

Drug Discovery is a time-consuming process that can extend to 5-12 years. Gen AI can help identify potential drug candidates and test their effectiveness using computer simulations, thus saving time in the process. It has already led to tremendous real-world value, when the first mRNA covid vaccines were developed by programming mRNA molecules to express the specific antigen response. By 2025, more than 30% of new drugs and materials could be systematically discovered using GenAI techniques, up from zero today.

Software development

IT products and services could see the biggest impact. Below are some scenarios that may unfold.

Credits

Lead Authors@lab45: Siddhant Raizada, Nagendra Singh, Tommy Mehl, Arvind Ravishunkar

Contributing Authors: Aishwarya Gupta, Anindito De

This is your invitation to become an integral part of our Think Tank community. Co-create with us to bring diverse perspectives and enrich our pool of collective wisdom. Your insights could be the spark that ignites transformative conversations.

Learn More

Key Speakers

Thank you for subscribing!!!