Develop AI strategy for your organization

Dr. Kavita Ganesan, Founder of Opinosis Analytics

Watch Now

14:40 Minutes The average reading duration of this insightful report.

Foundational for identity verification and rights access, government-issued IDs face breaches and inefficiency within centralized systems. Enter Decentralized Identity solutions, redistributing verification control to individuals. But is it applicable for equally for all government services?

Decentralization of government-issued IDs is a complex issue with potential benefits and drawbacks. Whether government issued Ids should be decentralized or not depends on various factors that we delineate. Any decision on decentralization should be carefully considered and implemented with caution to ensure that they do not breach security or undermine the government’s programs. Download Complete Research

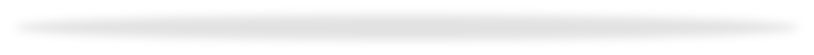

We detail out the current Issuing process typically followed by governments today and identify several challenges and issues that face it today. This includes Ids like the Passport, Licenses, Voter cards and Social security cards. All of them are critical and everyone can do with an easier and more fool proof process for the same.

We evaluate the different government functions such as Education, healthcare, elections, security, taxation, etc and analyze which of these would be most suitable to be decentralized. We map them on a matrix of Complexity & Coordination and the Need for scrutiny to give us an easy framework for assessment. Download Complete Research

We end by considering the long term onjectives and intended outcomes of such an exercise.We feel that Decentralized Identity solutions can rebuild trust in public institutions by empowering residents with data control.

Credits

Author@lab45: Sujay Shivram, Abhigyan Malik

13:30 Minutes The average duration of a captivating reports.

GenAI is transforming various domains including software engineering. This technology enables high productivity, rapid development, and abundant innovation promising overall productivity gains of 26-30%. Embrace the future and discover the extraordinary potential of GenAI.

GenAI is expected to boost productivity in software engineering by 28% and is projected to improve task completion speed by 54% by 2025. It can also increase application development and maintenance revenue by 25%-30%, leading to a 5%-6% improvement in overall profitability. The GenAI market is expected to grow at a CAGR of 42% over the next decade, and the technology can help address the expected shortfall of 4 million developers by 2025. However, detailed study and implementation strategies are needed to consider factors such as initial installation effort, resource training, and technology integration.

GenAI can significantly impact the various phases of software development by generating code, improving code quality, simplifying code structures, and automating tasks such as unit testing and bug detection. It can reduce the duration of task execution across various software development stages by 20%-45%, resulting in substantial cost savings. While software engineers may be the primary beneficiaries of GenAI, other teams, such as architects, consultants, and sales teams, can also derive substantial advantages. However, implementing GenAI requires a comprehensive strategy that includes tool selection, investment, deployment, and developer training. The implementation strategy should target the highest-leverage phases of software development, and enterprises should invest in resources and training necessary for developers to leverage the technology effectively. Download Complete Research

Integration of GenAI with DevOps principles can increase productivity by automating tasks, generating content, and providing intelligent insights. Adopting GenAI in the DevOps software development environment can further boost productivity through script generation, automated monitoring and alert generation, and synthetic data for pipeline load testing. GenAI can complement and enhance Low Code No Code (LCNC) capabilities by integrating visual developer interfaces, quickening development cycles, and creating text and multimedia assets. Key platforms for code generation using GenAI include Copilot by GitHub, CodeWhisperer by AWS, ChatGPT by OpenAI, Vertex AI by Google Cloud, and TabNine by Codota Dot Com Ltd.

As AI continues to evolve, GenAI will become an increasingly essential aspect of the software development process. GenAI provides opportunities for innovation and creativity while also presenting new challenges. Customized benchmarking contextualized to the customer environment is crucial in refining and optimizing GenAI tools, fostering greater productivity and efficiency in software development. Enterprises must formulate a comprehensive GenAI strategy and incorporate GenAI tools in the implementation and testing phases of the software development lifecycle to maximize development cost and effort savings and improve quality. Collaboration with GenAI tools will create new roles, such as Prompt Engineers, and allow developers to focus on strategic thinking and creative problem-solving. GenAI is also an excellent learning and training tool, automating the generation of educational content and assisting in information retrieval and organization. Download Complete Research

Credits

Lead Authors@lab45: Hussain S. Nayak, Anju James

Contributing Authors@lab45: Vinay Ramananda, Dattaram B A

16:10 Minutes The average duration of a captivating reports.

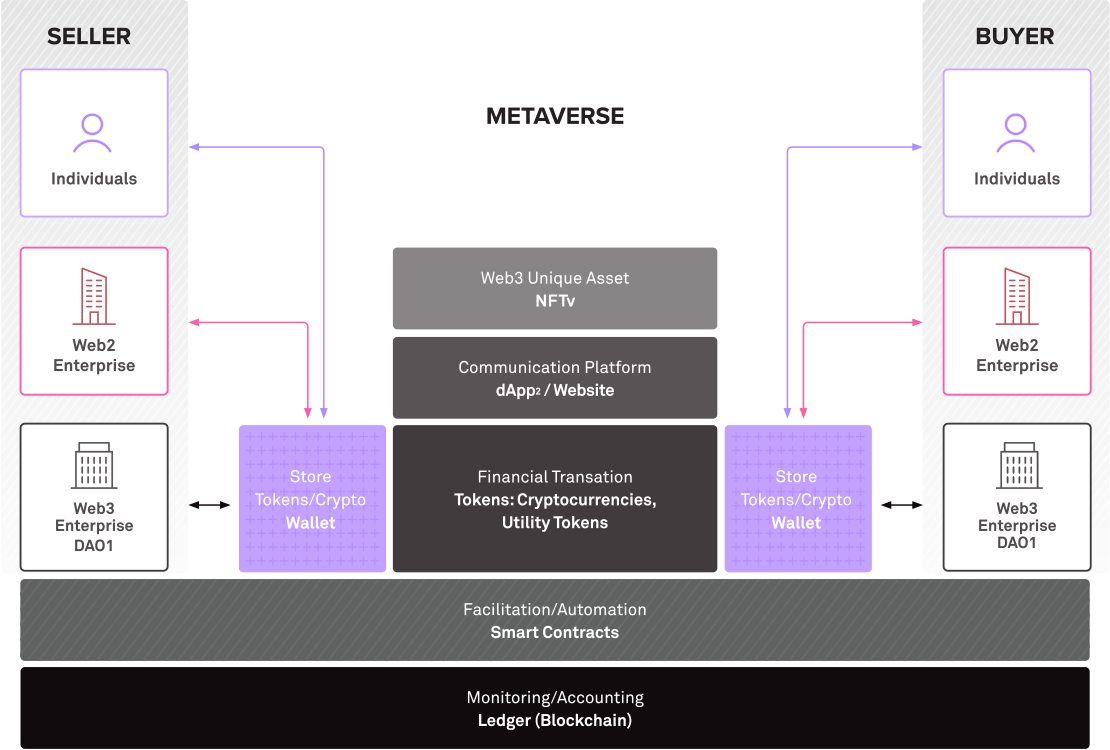

Discover the revolutionary world of Web3 in this compelling paper, where we delve into its fundamental building blocks and crypto tokens that underpin this decentralized paradigm shift. Explore the exciting enterprise use-cases harnessing the true potential of Web3 technology, revolutionizing industries and unlocking unprecedented opportunities.

What's inside

Web3 represents a decentralized web powered by blockchain, enabling decentralized participatory communities. It promotes user control over data, governance, and transactions. The transition from Web2 to Web3 encompasses decentralization of user data and content, finance and currency systems, and immersive user experiences. Web3 leverages crypto tokens, digital assets issued on blockchains, and utilizes smart contracts for decentralized finance. These tokens are essential for Web3 and its growth. Web3's potential lies in building digital communities, disrupting economic representation, and co-creating value within token networks. Blockchain underpins Web3, ensuring secure transactions and smart contracts. Non-Fungible Tokens (NFTs) play a role in ownership and provenance of digital assets.

The growth of crypto markets until 2021 was remarkable, but the web3 community remains relatively small. By November 2021, about 7 million people were using token wallets monthly. Crypto is volatile, with fundamental flaws and regulatory challenges. The complexity of web3 poses risks in regulation, technology, and security. EU, USA, and China may not fully support crypto. However, digital tokens can still find a counterculture of users valuing crypto custody and communities. Web3's potential to benefit the public is uncertain. Adoption paths vary, and tokens could disrupt traditional systems, but regulatory hurdles and fraud might impede progress. VC investments in web3 exceeded $18 billion in H1 2022, indicating significant interest and potential. Download Complete Research

Tokens are most impactful when they unite micro-communities to create long-term value. However, many token projects remain immature and fail to generate value due to the absence of robust economies. Centralized enterprises and their brands could play a significant role in web3 by building token ecosystems around their communities, blurring the line between utility and investment. Brands can use NFTs for reinvented customer loyalty programs and create DAOs for crowdsourcing productivity. Successful token development depends on an engaged community, and brands can incentivize fans to participate actively. Notable brands like Nike and Starbucks are already exploring web3 and NFTs. Mainstream and decentralized brands are recognizing the potential of engaging with digital-native fan communities in the web3 space. Download Complete Research

Web3's tokens hold enormous potential but also significant risks. Users are responsible for token custody and must secure them cryptographically. Cybercrimes can lead to substantial financial losses. Token fraud and money laundering are concerns due to anonymity. Regulatory challenges are growing, with potential impacts on tax codes and transactions.

Credits

Author@lab45: Ankit Pandey

This is your invitation to become an integral part of our Think Tank community. Co-create with us to bring diverse perspectives and enrich our pool of collective wisdom. Your insights could be the spark that ignites transformative conversations.

Learn MoreKey Speakers

Thank you for subscribing!!!