Uncovering GenAI tools and infrastructure

Rajat Monga, Co-Founder, TensorFlow

Watch Now

12:49 Minutes The average reading duration of this insightful report.

Generative AI is forming a new economic ecosystem, reshaping the behaviour of key players in the IT industry, generating opportunities for super-scalers, and unveiling numerous niches for startups. The outlines of this new IT landscape are emerging, prompting a closer examination.

Explore a sneak peek of the full content

Generative AI has caused significant disruption, expanding its offerings and services well beyond traditional AI domains. This has led to an explosion of potential use cases for customers who aren’t AI experts. Unlike before, customers no longer require a team of AI experts, curated data, or precisely measurable outcomes to adopt AI tool and gain immediate benefits. The interaction with GenAI is so seamless and intuitive that the onboarding for new customers is frictionless, eliminating barriers to adoption and facilitating rapid technology spread. The high variability in potential inputs and priming of generative models allows for a diverse range of applications impacting nearly every imaginable aspect of people activities. This is a foundation of a new era of Artificial Intelligence.

In this primer we leveraged our knowledge of 50+ GenAI-related and VC-backed startups to reconstruct the technological stack of the forming GenAI space.

Large tech companies are leveraging their existing technological and capital advantages to create the framework for the GenAI market landscape, which we are going to explore in this section.

While offering of the LLMs on the current scale and heavy focus on unstructured data are somewhat new, the other elements of the tech stack closely mirror those needed for any large computational modeling. Established companies in the field of traditional AI are at an advantage, as they can expand and repurpose preexisting software, infrastructure, and services. Download Complete Research

While large players are occupying a sizable portion of the GenAI tech stack, there remains more than enough room for GenAI startups to flourish. The landscape of AI and ML is continuously evolving, with new startups, technologies, and methodologies emerging regularly.

Bottom-right (AIOps): Here, startups may offer tools for easier adoption of LLMs, facilitating the initial process of customizing and implementing these models.

Ascending (Integration): Moving upwards represents the process of integrating LLMs into various applications and business operations. Startups could offer integration services, templates, or frameworks to streamline this, or build an entire end to end app for a selected market niche.

Moving left (Service platforms): As we move leftwards, the focus shifts from core LLM functionality to auxiliary services. This could range from platforms offering specialized training data, to marketplaces for LLM apps, to optimization tools. These firms may automate the need for certain experts.

This taxonomy can serve as a foundational overview for anyone looking to understand the current state of the LLM ecosystem. It’s also worth noting that the landscape of AI and ML is continuously evolving, with new startups, technologies, and methodologies emerging regularly. Let’s inspect each block in greater detail:

The future of the GenAI landscape is going to be defined by several processes:

While enhancing the users with great capabilities, the LLM-based service is neither a freebie, nor a cornucopia. Each implementation of LLMs carries its own advantages and downsides. In this section of the Appendix, we discuss what can and cannot be realistically expected from a GenAI model in each of the most popular use cases.

We start with primary properties of a pre-trained LLM model, underlying its strong sides and functionalities as well as build-in flaws. And we move to the current ways of augment LLM model to work around the flaws. Download Complete Research

The table of 78 startups we have based our analysis on is presented in this section.

The states of startups are set to the August of 2023.

Credits

Author@lab45: Rinat Sergeev

14:37 Minutes The average duration of a captivating reports.

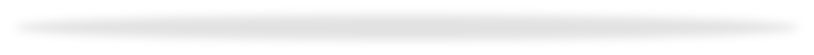

Decentralized Identity systems solve for inefficiencies and security breaches, making them extremely useful for enterprises. We explore in detail important industry use cases where these solutions can be used and means to implement them.

The KYC Process in Banks and Financial institutions is mandated by the government and can be quite painful both for the bank and the customers. We examine how DID can help not only simplify the process but also ensure high trust and make the process fraud proof, by eliminating intermediaries and returning to trusted direct relationships. Download Complete Research

In case of Food supply the application of IoT can provide real-time data and insights. The current IoT supply chain and the food Supply chain face innumerable challenges. Using DID and verifiable credentials in food/perishable supply chain can provide a tamper-proof and auditable record of a product’s journey, from its origin to its destination. Solution will have lasting impact not only for controlling quality and expense for organization but will also have impact on public nutrition, health, and sustainability. We explore how!

While managing Electronic Health Records, healthcare organizations face two main challenges: Privacy & Security and Interoperability due to multiple systems in play. By providing patients with greater control over their health information, Decentralized Identity solutions can enhance trust and confidence in the healthcare system, leading to better health outcomes. We explore the details with an example. Download Complete Research

Credits

Author@lab45: Sujay Shivram, Abhigyan Malik

17:48 Minutes The average duration of a captivating reports.

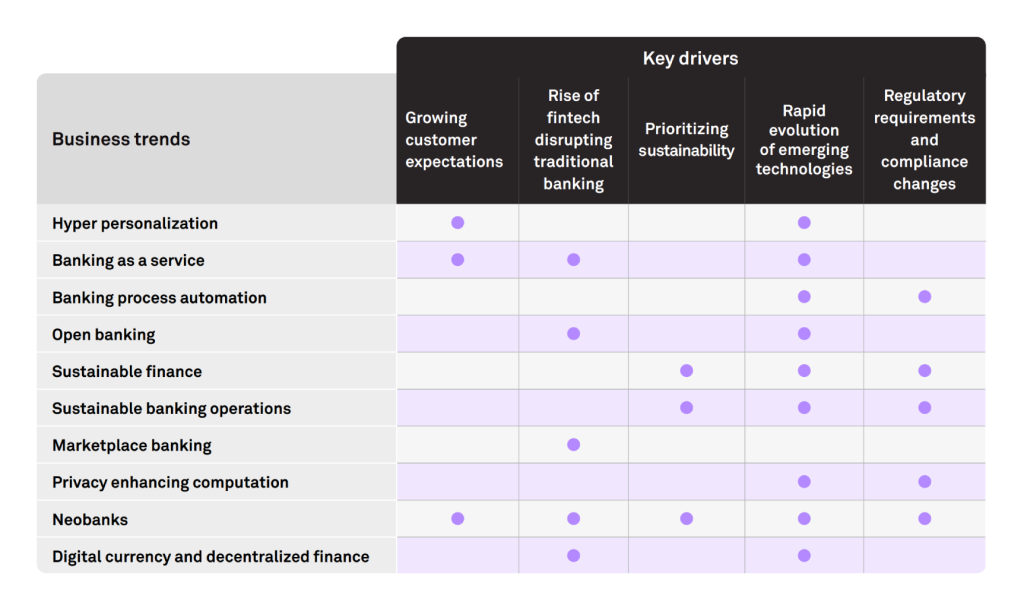

The banking sector is experiencing significant changes primarily driven by the growing integration of technology into consumers’ daily lives, evolving customer expectations, increasing interest in digital money and the volatility of cryptocurrencies. The potential annual value of AI and analytics for the global banking industry is expected to be as high as $1 trillion.

Credits

Lead Authors@lab45: Deepika Maurya, Chandan Jha

Contributing Authors@lab45: Sujay Shivram, Hussain S Nayak

This is your invitation to become an integral part of our Think Tank community. Co-create with us to bring diverse perspectives and enrich our pool of collective wisdom. Your insights could be the spark that ignites transformative conversations.

Learn MoreKey Speakers

Thank you for subscribing!!!