How AI will impact your business

Shikhar Ghosh, Professor, Harvard

Watch Now

16:10 Minutes The average reading duration of this insightful report.

Discover the revolutionary world of Web3 in this compelling paper, where we delve into its fundamental building blocks and crypto tokens that underpin this decentralized paradigm shift. Explore the exciting enterprise use-cases harnessing the true potential of Web3 technology, revolutionizing industries and unlocking unprecedented opportunities.

Explore a sneak peek of the full content

What’s inside

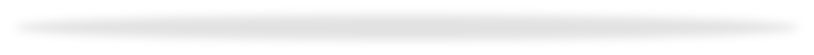

Web3 represents a decentralized web powered by blockchain, enabling decentralized participatory communities. It promotes user control over data, governance, and transactions. The transition from Web2 to Web3 encompasses decentralization of user data and content, finance and currency systems, and immersive user experiences. Web3 leverages crypto tokens, digital assets issued on blockchains, and utilizes smart contracts for decentralized finance. These tokens are essential for Web3 and its growth. Web3’s potential lies in building digital communities, disrupting economic representation, and co-creating value within token networks. Blockchain underpins Web3, ensuring secure transactions and smart contracts. Non-Fungible Tokens (NFTs) play a role in ownership and provenance of digital assets.

The growth of crypto markets until 2021 was remarkable, but the web3 community remains relatively small. By November 2021, about 7 million people were using token wallets monthly. Crypto is volatile, with fundamental flaws and regulatory challenges. The complexity of web3 poses risks in regulation, technology, and security. EU, USA, and China may not fully support crypto. However, digital tokens can still find a counterculture of users valuing crypto custody and communities. Web3’s potential to benefit the public is uncertain. Adoption paths vary, and tokens could disrupt traditional systems, but regulatory hurdles and fraud might impede progress. VC investments in web3 exceeded $18 billion in H1 2022, indicating significant interest and potential. Download Complete Research

Crypto tokens are integral to decentralized finance (DeFi), enabling peer-to-peer transactions and powering various financial activities without intermediaries. They are disruptive technologies that are still nascent and complex.

Tokens are most impactful when they unite micro-communities to create long-term value. However, many token projects remain immature and fail to generate value due to the absence of robust economies. Centralized enterprises and their brands could play a significant role in web3 by building token ecosystems around their communities, blurring the line between utility and investment. Brands can use NFTs for reinvented customer loyalty programs and create DAOs for crowdsourcing productivity. Successful token development depends on an engaged community, and brands can incentivize fans to participate actively. Notable brands like Nike and Starbucks are already exploring web3 and NFTs. Mainstream and decentralized brands are recognizing the potential of engaging with digital-native fan communities in the web3 space. Download Complete Research

Web3’s tokens hold enormous potential but also significant risks. Users are responsible for token custody and must secure them cryptographically. Cybercrimes can lead to substantial financial losses. Token fraud and money laundering are concerns due to anonymity. Regulatory challenges are growing, with potential impacts on tax codes and transactions.

Credits

Author@lab45: Ankit Pandey

11:45 Minutes The average duration of a captivating reports.

AIoT is a revolutionary blend of AI and IoT that creates a connected world with limitless opportunities. Smart devices can collaborate to make informed decisions without human intervention, transforming various industries. As AI and IoT converge, their applications will become more advanced, presenting new prospects for businesses and consumers.

AIoT combines sensors, AI, data and ambient computing elements to create a responsive, context-aware environment. It uses embedded devices and natural user interfaces to provide services based on detected requirements and user input.

AIoT can revolutionize how users interact with technology, offering greater convenience and seamless connectivity. The benefits include: intuitive and seamless experience without commands, automated decision making, efficiency and convenience.

While creating an AIoT system, a well-balanced architecture is crucial to manage data processing speed and costs. There is a flow of information in the system based on the external inputs, that ultimately results in a response based on analysed data points by AI and ML algorithms. Download Complete Research

The 5 step enterprise strategy include the following:

Use Cases for following domains are discussed:

Implementing a complex system like AIoT requires careful planning, collaboration, and attention to detail. Data management, privacy concerns, and integration with various systems can pose significant obstacles to successful implementation.

The AIoT space is dominated by key players such as IBM, Microsoft, Siemens, GE, Cisco, Huawei, ABB, Bosch, SAP, and Honeywell. Download Complete Research

Credits

Author@lab45: Anju James

Contributing Authors@lab45: Hussain S Nayak, Nagendra Singh

14:07 Minutes The average duration of a captivating reports.

Discover the transformative impact of ChatGPT in the business world. Explore its potential in natural language processing, AI's role in enterprise strategy, and how leaders can leverage this technology for growth and innovation.

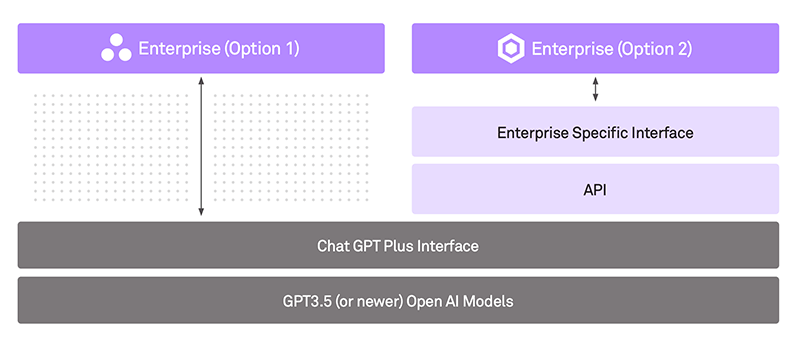

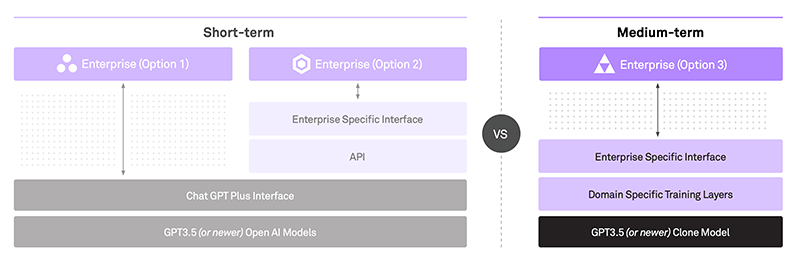

Short-term deployment strategies

In the immediate future, the emphasis is on implementing ChatGPT Plus and its API in selective functions within enterprises. This phase aims to measure the return on investment by integrating ChatGPT in various divisions, particularly in areas like code development and marketing. A key benefit of this approach is the potential enhancement of employee productivity through accelerated learning and execution, leveraging ChatGPT’s advanced capabilities.

Medium-term licensing and training

For a 6-month to 1-year outlook, the focus shifts to licensing GPT3.5 and tailoring it with company-specific intelligence. This move aims to bypass the limitations of the general-access SaaS model and utilize ChatGPT’s full potential. By customizing the AI with domain-specific data, enterprises can create distinctive products or services, thereby gaining a competitive edge.

Considerations and limitations

Key considerations include the confidentiality of data, the competency and adaptability of employees, and the initial costs and resources required for deployment. The hardware prerequisites, licensing costs, and additional expenses for model training are also crucial factors. The strategy involves a careful balance of immediate benefits against long-term investments, ensuring that the integration of ChatGPT aligns with the enterprise’s overall objectives and capabilities. Download Complete Research

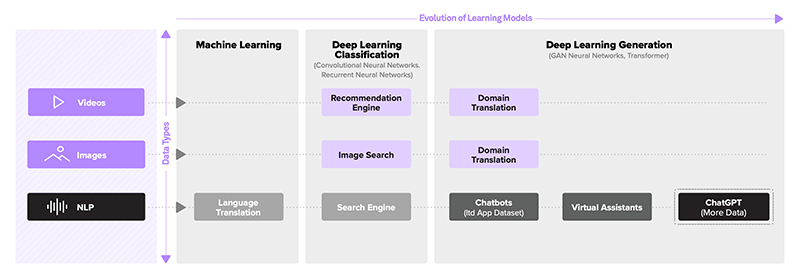

Evolution of machine learning and deep learning

The foundation of ChatGPT's technology lies in the evolution of machine learning, a key subset of artificial intelligence where computers are trained to emulate human performance. Initially, machine learning powered simple applications like search and recommendation engines. Over time, it evolved into deep learning, which uses neural networks for more complex tasks. These neural networks, comprising units called artificial neurons, mimic the human brain's functioning, processing data through interconnected nodes. This advancement is evident in modern applications ranging from chatbots to intelligent assistants.

Breakthrough with transformer models

A significant leap occurred in 2017 with Google's introduction of transformer models. These models, central to ChatGPT's technology, excel in processing entire sentences and generating text. They operate using an encoder-decoder mechanism and focus on the 'attention' principle, determining the relevance of each word in a context. OpenAI's investment in these models led to the development of GPT (Generative Pre-trained Transformer) series, culminating in ChatGPT.

Factors Contributing to ChatGPT's Success

This section highlights the technological advancements behind ChatGPT, illustrating its journey from basic machine learning applications to sophisticated natural language processing capabilities. Download Complete Research

Accuracy and misinformation

ChatGPT's training on extensive internet data poses risks of inaccuracy and misinformation. It often lacks the latest updates and struggles to differentiate between fact and fiction, leading to potential misinformation, especially for non-experts.

Contextual understanding and bias

Another limitation is its inability to interpret emotions or hidden intentions, potentially resulting in inappropriate responses. Furthermore, biases in its training data can skew ChatGPT's outputs, reflecting these inherent biases in its responses.

Operational costs and legal implications

Maintaining ChatGPT involves significant costs due to its complex system requiring regular updates. Additionally, legal challenges, such as copyright issues, can arise from its text generation capabilities.

Environmental impact

The energy consumption for running ChatGPT is substantial, contributing to environmental concerns. The costs, both financial and environmental, of operating data centers and processing large datasets are significant, highlighting a need for more sustainable practices.

This section highlights ChatGPT's main challenges: accuracy and bias issues, high operational costs, legal risks, and environmental impact. It emphasizes the need for addressing these concerns for its effective and responsible use. Download Complete Research

Credits

Lead Authors@lab45: Arvind Ravishunkar, Dinesh Chahlia, Nitin Narkhede, Noha El-Zehiry

Contributing Authors@lab45: Aishwarya Gupta, Anindito De

This is your invitation to become an integral part of our Think Tank community. Co-create with us to bring diverse perspectives and enrich our pool of collective wisdom. Your insights could be the spark that ignites transformative conversations.

Learn MoreKey Speakers

Thank you for subscribing!!!